KARACHI: Gold prices in Pakistan climbed sharply on Monday, mirroring the global surge that pushed the yellow metal to fresh records.

The price of 24-karat gold rose by Rs6,100 per tola, reaching Rs384,000.

According to rates shared by the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA), the 10-gramme rate also increased by Rs5,230, standing at Rs329,219. Meanwhile, 22-karat gold was quoted higher at Rs301,794 per 10 grammes.

Global push lifts bullion

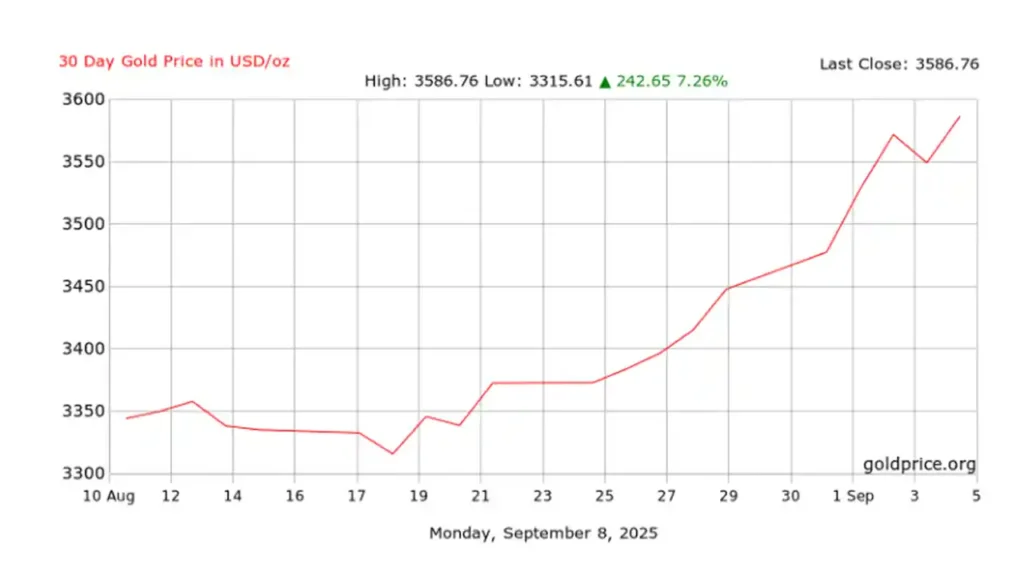

International markets provided strong support for the domestic rally. Spot gold traded near $3,612 per ounce, up 0.7 percent during early trading, after briefly touching a record high of $3,616.64. The metal has now gained 37 percent so far in 2025, building on a 27 percent rise in 2024.

Analysts link the sustained demand to a weaker US dollar, steady central bank buying, and concerns over economic uncertainty.

The biggest trigger in recent days has been a weaker-than-expected US jobs report, which showed that job growth slowed sharply in August while unemployment rose to 4.3 percent, the highest in nearly four years.

The data fuelled expectations that the US Federal Reserve will cut interest rates at its policy meeting next week, making non-yielding assets like gold more attractive.

Record run in September

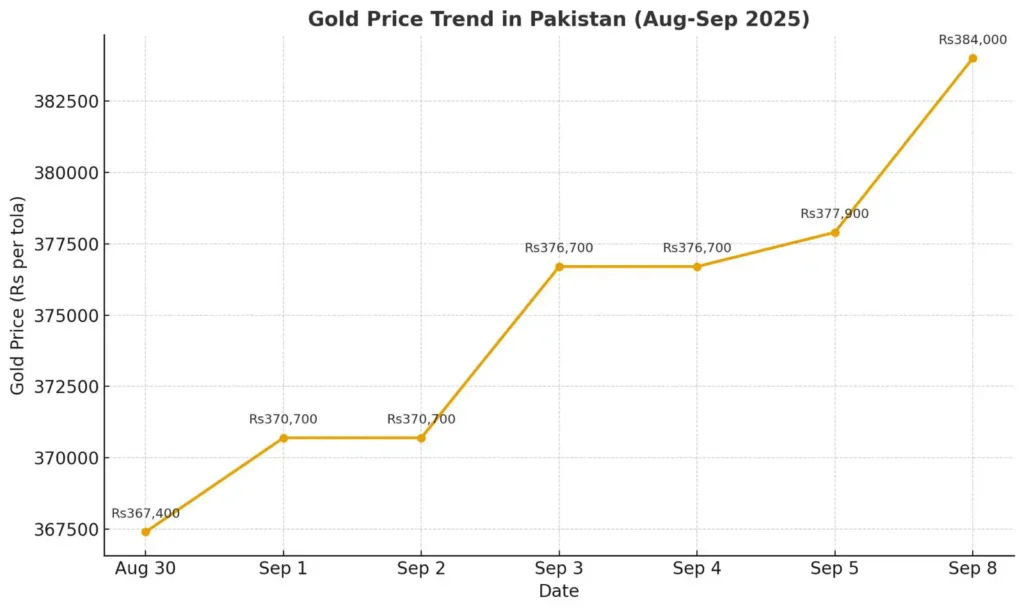

The local market has also seen a string of record highs since the start of September. Gold ended August at Rs367,400 per tola. On September 1, it jumped to Rs370,700, setting a new record. Prices held steady on September 2 before touching another peak of Rs376,700 on September 3.

After stabilising for a day, the rally resumed on September 5 with prices climbing to Rs377,900. Monday’s surge to Rs384,000 now marks the steepest rise so far this month.

What it means for investors

For Pakistani investors, the continued surge offers both opportunities and challenges. On the one hand, those who had already invested in gold have seen significant gains in a short span of time.

Gold has historically acted as a hedge against inflation and currency weakness, making it an attractive choice in uncertain economic conditions.

On the other hand, rising prices make it harder for new investors and ordinary buyers, especially households purchasing jewellery for weddings or savings. Traders also warn that volatility remains high, and any shift in the Federal Reserve’s policy outlook could trigger sharp swings.

Outlook

Market watchers believe gold may remain under upward pressure in the coming days, especially if the Fed delivers the expected rate cut. However, they caution that corrections are possible given the speed of the recent rally.

For now, both global and local markets remain gripped by gold fever as the precious metal continues to smash through milestones.